Castle Pines North to Vote on Incorporation – Results of Economic Feasibility Study Announced

by Lane Roberts

Castle Pines North (CPN) is at an important crossroads. The long-awaited vote on incorporation is finally approaching. After more than 11 months, CPN residents will cast their vote on incorporation in a mail ballot coordinated with Douglas County on November 6.

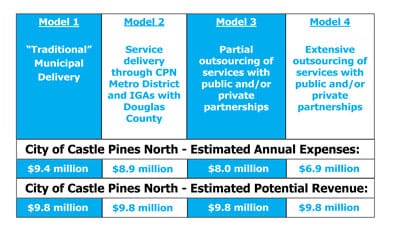

At three community information meetings held at local schools on September 24, 25 and 26, residents were presented with the results of the economic feasibility study that was developed by CH2M HILL OMI. The six-month extensive research project was consolidated into a short presentation that explored four basic models for a new city.

“The objective of the study was to determine if the proposed City of CPN would be financially feasible based on potential operating expenses and revenues,” said Castle Pines North Preservation Committee Leader Maureen Shul. “We did not want to simply create a ‘first year only’ city budget. Four potential models for a city were explored.”

|

|

If incorporation is successful, residents will then vote to elect a part-time mayor, clerk, treasurer, and part-time city council in early 2008. Newly elected council members would then select one of the four proposed models for the new city that were recommended in the economic feasibility study.

The study also explored estimated operating costs for each model and estimated potential revenues.

According to the study, estimated annual expenses for the new city would range from $6.9 million to $9.4 million. An extensive budget for a “traditional” city was also created; however, Preservation Committee leaders are hopeful that CPN can utilize one of the other three models for more efficient services and to minimize costs through outsourcing and contracting of services.

|

|

Current Services in CPN –

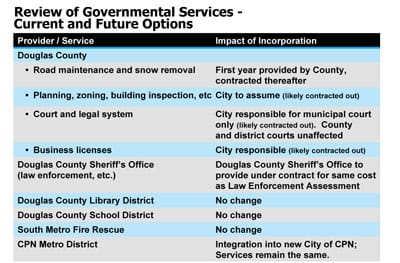

The study also explored current governmental services and the impact incorporation would have on the community. “Issues like road maintenance, police and fire protection are important to residents of CPN, so we made a point to look very carefully at current services we receive,” said Shul.

What about the CPN Metro

District?

A financial review of the CPN Metro District was also part of the feasibility study. CH2M HILL OMI is recommending that the Metro District be integrated into the new city. “Cities have more bonding capacity for renewable water than most small Metro Districts,” said Doug Gilbert, Preservation Steering Committee leader. “The services provided by the Metro District – water, sewer, storm drain – would remain the same, only the Metro District would be integrated into the new city.”

What about Community HOAs?

A complete analysis of HOAs was included as part of the study. Each HOA budget was reviewed and input was collected from various HOA boards. CH2M HILL OMI also identified a duplication of services among HOAs. Currently, HOAs in CPN have annual expenses of $4.46 million. CPN has more than 30 HOAs and sub-HOAs. Many residents pay fees to three or four HOAs.

“HOAs will remain autonomous within a new city. There isn’t, and never was, any intention for a new city to take the place of individual HOAs,” said Shul. “However, if we become a city, the new council will work closely with HOA leaders to explore ways to be more efficient, which would result in a cost savings to homeowners.”

|

|

Projected Sources of Revenue –

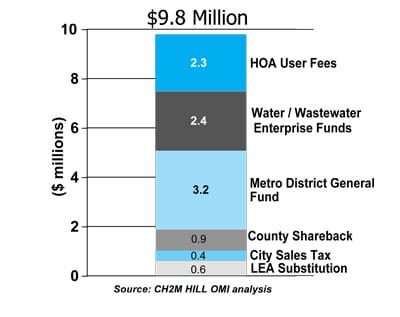

Estimated revenue sources for the new city were also explored. According to CH2M HILL OMI, the new city could generate approximately $9.8 million in revenue. This would include shareback revenue from the State and County, which is estimated to generate almost $1 million for the new City.

In addition, CH2M HILL OMI recommended a 2.75 percent sales and use tax for CPN area businesses. Because CPN will be a “statutory city,” this tax will NOT apply to food. The projected revenue from sales tax is $400,000. “With this tax rate, CPN will be very competitive in comparison with neighboring communities that have much higher sales tax rates,” said Shul.

Another revenue source includes user fees from combined purchasing and resource sharing among HOAs. In addition, the integration of the Metro District into the new city would include potential water and wastewater enterprise fund revenue. The Metro District’s general fund would be transferred to the new city. The Law Enforcement Assessment (LEA) would also be transferred from Douglas County to the new city. These important TABOR issues will be listed as separate questions on the November ballot.

|

|

Will CPN Have New Property Taxes?

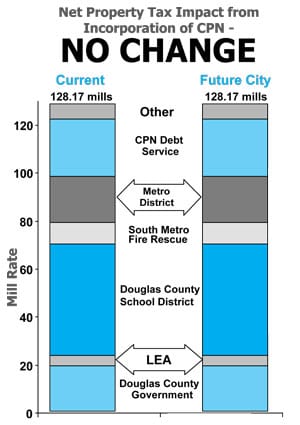

Currently, Castle Pines North residents pay 128.17 mills. This includes various property taxes paid to Douglas County, Douglas County School District, Law Enforcement, South Metro Fire Rescue, the CPN Metro District and the CPN bond debt service.

According to CH2M HILL OMI, the incorporation of CPN can be accomplished with NO new property tax (or mill levy) increase. The mills from the CPN Metro District and the Law Enforcement Assessment would simply be transferred to the new city upon voter approval. This transfer of funds will be used for the same services currently being provided at the same cost.

“Our goal has been to avoid ‘big government’ and to avoid raising property taxes,” said Shul. “We are confident CPN can incorporate and operate efficiently as a new 21st century city. Now it’s up to the voters of CPN to make their decision for our future.”

The Bottom Line…

Castle Pines North is at an important crossroads. Which direction should we go? Recent results of the economic feasibility study found a vote for all four incorporation ballot questions means:

NO new property taxes

(no mill levy increase)

A sales tax of 2.75%

(not to include food items)

The entire economic feasibility study presentation can be viewed at www.cpnpc.org. Send questions or comments to Contact by email.