Urban Renewal Triggers Controversy; Communication

by Linda Nuzum

Urban Renewal Triggers Controversy; Communication

The Castle Pines North (CPN) City Council’s recent approval of an Urban Renewal Authority (URA) and Plan has triggered a number of responses, including a call for CPN citizens to vote on the URA Plan; three lawsuits; City negotiations with other local governments which could see their future tax revenues impacted by the URA; and new communication efforts by the City.

Call for CPN voters to decide

A group of Castle Pines North citizens is calling for a public vote on the URA. Last week, the group submitted a draft format of the petition to the city for approval. On Monday, the CPN city clerk rejected the request, citing technical flaws in the format.

Petition organizers indicate that they will submit a revised request. Once the city finds the petition format acceptable, the citizen group will collect signatures of CPN registered voters on petitions requesting the vote. If sufficient signatures are gathered, then the City Council would set an election date.

The group has set up a website with information about their effort, at www.blightsnotright.com (no longer available).

Legal Action

Three complaints were filed in Douglas County District Court on May 27, which was the deadline for filing legal challenges to the formation of the URA:

The Happy Canyon HOA. Ten years ago, the developers of The Canyons signed an agreement with the Happy Canyon HOA that restricted future development on the property to basically the zoning that the County had approved in the year 2000. Last year, the city annexed the property and approved higher-density zoning; however the new zoning cannot go into effect as long as the restrictive covenants continue to exist. The HOA filed their legal complaint with the court, and issued a statement asserting that the city’s approval of the URA and Plan were part of a “deliberate effort to terminate our Agreement.”

Douglas County. Douglas County government officials have indicated that they wish to continue negotiating with the city regarding concerns that the county has with the URA and the Plan, however the county noted in its letter presented at the May 25 public hearing that the County would “avail itself of all legal remedies” to “ensure that the County impacts are in fact addressed.” Click here for a pdf copy of the county’s letter to the city.

Castle Pines North Metro District. The CPN Metro District also indicated that there was not time to resolve concerns prior to thecCity’s May 25 vote to approve the plan, or the Court’s May 27 deadline for filing legal objections to the URA. A formal release issued by the District “expressed the Board’s willingness to work directly with the mayor and city council to resolve issues without litigation,” and outlined some of the issues to be resolved. Click here for CPN Metro’s statement.

Intergovernmental Agreements

In May, the city met with other local governments in the area to begin discussing the impact that future URA decisions to approve “Tax Increment Financing” would have on those entities’ future tax revenues, and the city has offered to discuss Intergovernmental Agreements (IGA’s) with each entity (See the “TIF Finacing” section of this article, below, for more on how TIF works).

On June 8, the city council approved language offering agreements to three taxing entities: the South Metro Fire and Rescue Authority, Castle Rock Fire District (which serves the portion of The Canyons just north of Crowfoot Valley Road), and the Parker Water & Sanitation District (which serves The Canyons). These potential agreements must next be approved by the CPN URA Commission, and then by the Board of Directors for the affected tax district.

In these agreements, the city promises that if the URA does approve any future projects to use TIF financing, the City/URA will negotiate to return a portion of the TIF funds to the tax district, according to broad parameters outlined in the agreement, and the tax district agrees not to file legal objections to the URA Plan.

Negotiations are still pending with the other affected entities, including Douglas County, Castle Pines North Metro District, Douglas County School District, and Douglas County Libraries. The Sheriff’s Office will not be affected, since it has an existing contract with the city.

City information on URA

The city has hired a marketing firm to initiate new communications efforts to help explain the URA. The city sent a letter to CPN residents, and has established a new website on the URA topic, at http://cpnfacts.com/urban-renewal/.

BACKGROUND

What’s in the URA Plan?

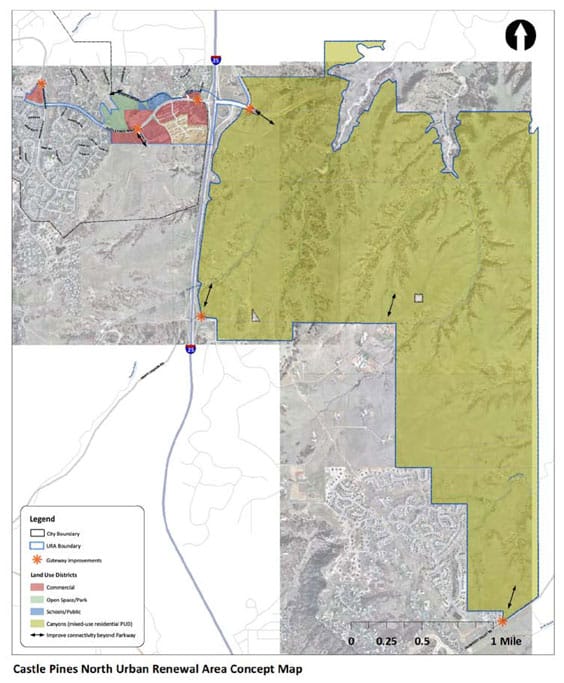

As illustrated on the map, the URA Plan includes two main sections, one on the “East Side” of I-25, and other on the “West Side” of I-25.

The East Side is the future Canyons development.

The West Side properties include:

CPN business district: the existing commercial development such as the Safeway, King Soopers, and Village Square centers; the adjacent apartment complex, and adjacent undeveloped commercial lots. In addition, the existing business district could be expanded slightly to include three lots just north of Castle Pines Parkway, between I-25 and the Conoco station, which are not currently within City boundaries but the property owners are currently considering annexing into the City and the URA, and applying for commercial zoning.

The CPN Community Center/ Metro District office building, and the adjacent vacant parcels surrounding that building, which comprise the site of the potential future Castle View Park, and the the Montessori School.

The “CC20” parcel at the northwest corner of Monarch Boulevard and Castle Pines Parkway, which is zoned for commercial development.

Why did the City form the URA?

City officials have emphasized that “The primary reason behind approval of the Urban Renewal Plan is to enhance and revitalize the existing and future business districts.”

One frequently-mentioned benefit is the ability of the URA to solve some issues such as inadequate traffic flow and parking in the existing business areas, which were each built as separate developments with different owners and thus did not have an overall master plan for how they would all fit together.

There has been less discussion on the intended use of the URA powers in the other portions of the URA boundary.

For more information on the City’s rationale, visit http://cpnfacts.com/urban-renewal/; also visit the City’s main website, http://www.cpngov.com and view URA-related documents that are posted near the bottom of the home page.

What is TIF financing?

One of the hot topics in the URA discussion is Tax Increment Financing (TIF), which is one of the powers that state law allows URA’s to use. Creating a URA Plan does not automatically invoke TIF or any other URA financing options; these would only come into play if and when the URA Authority takes the next steps, to approve specific projects and financing mechanisms for those projects.

However, the discussion of TIF is starting now, since state law requires all URA plans to include an analysis of the impact that potential TIF financing could have on the affected government units’ future tax revenues.

To help understand the impact of TIF financing, first explore how taxes work in developments that occur without TIF financing, such as Castle Pines North or Castle Pines Village:

The developer pays for the roads and other infrastructure needed for the development by creating Metro Districts for that specific property, to issue bonds to finance these costs. The taxpayers within the boundary of that specific Metro District pay additional property taxes to cover their Metro District’s bond payments.

Once the development takes place, the value of the properties goes up, and therefore generates extra property tax revenues. All tax districts that provide services to the property, such as the county, school district, library, water, and fire districts, gain increased revenues based on the value of the new development.

But if the URA does approve a project that includes TIF financing, here’s how it works:

The existing tax districts would get just the “base” tax revenue that they would have received if no new development had occurred, under the theory that if there was no TIF financing available to help fund the improvements, there would be no new development and thus no new tax revenue.

The (“incremental”) revenue that is generated from the new development is paid to the URA instead of the usual tax districts. The URA can then use available TIF funds to build infrastructure for the development, reducing the need for the project area’s Metro District to issue bonds and assess additional property taxes.

The existing tax districts argue that this approach denies them the increased revenues they will need to meet the development’s increased demand for their services, and that the costs for serving the development will end up being paid by the taxpayers from the rest of their service area, around the County, and in some cases, taxpayers statewide.

As state law requires, the City’s URA consultant has produced an “impact study” that shows how much tax revenue may be affected, assuming a conservative estimate of the development that may occur during the 25-year life of the URA. The consultant’s study estimated that a total of more than $47 million in new “incremental” tax revenue could be diverted to the URA. (The actual number could end up being higher or lower, depending on whether there was more or less actual development than the assumptions used in the consultant’s study).

The consultant’s impact study looks at the entire URA TIF boundary as a whole, but the impact of a specific TIF project would vary, depending on the exact location of the project.

For a project in the existing CPN business district, the “incremental” tax that would go to the URA is likely to be relatively small – the property is already taxed as commercial property, so the increase in tax revenues would only be for the marginal increase in the value of the commercial property.

For a project in The Canyons, the “incremental” tax revenues would be much greater, because the property is currently taxed at very low “agricultural use” tax rates (the County reports that the current annual tax bill for the entire Canyons development is just $3,656), but once the commercial development occurs, it would convert it to the much higher “commercial” tax rates.

The URA can use the “incremental” TIF revenue ONLY for funding “public improvements” that help to make the development possible. The URA can pay for these projects directly, or a landowner or developer can pay the cost of the qualifying project and get reimbursed by the URA. TIF funds cannot be used to pay a developer for any expenses that are not qualified as a URA-approved public benefit project.

If / when the URA approves a project with TIF funding, then the city and URA Authority may choose to enter into binding Intergovernmental Agreements (IGA’s) with affected tax entities, and may agree to refund some or all of the TIF funding back to the original tax entity. The city’s current negotiations with some of the affected entities would lay the groundwork for definitive IGA’s that may be adopted when specific TIF projects are approved.

The framework being discussed with the two affected fire districts states that, if a TIF project is approved, then the City and the URA Commission would negotiate with the affected fire district to share back the amount of revenues that the fire district would need to serve the property, and the URA would retain the rest of the revenue.

The framework being discussed with Parker Water & Sanitation District is that the city/URA would share back the revenues related to Parker W&S bonds, but that the URA would be able to keep the TIF revenues related to Parker W&S operating and maintenance expenses.

How does the URA plan affect The Canyons?

Much of the discussion about the URA plan has revolved around The Canyons, the new development that was annexed and zoned by the City in October 2009. Two primary issues are being discussed:

Whether it is appropriate to use urban renewal incentives, such as TIF financing, for new developments on agricultural land. During the past several years, a number of cities have utilized URA funding to support new developments. These projects have been widely criticized as an abuse of the intent of urban renewal, which was originally authorized to redevelop existing urban areas. The state has now passed a law that makes it much more difficult for cities to include agricultural land in an Urban Renewal area. HB1107 passed with strong bipartisan support, and went into effect on June 1. However, the City’s URA plan, which includes The Canyons’ agricultural land, can move forward because it was adopted on May 25, prior to the June 1 effective date of the new law.

Whether the URA powers could be used to modify restrictive covenants that The Canyons’ developers placed on the land. In the year 2000, the developers signed a contract with the Happy Canyon and Pinery HOA’s, limiting densities to match the zoning that the county had approved. In 2009, the developer annexed into the City of Castle Pines North, and the city approved higher-density zoning. However, the developers’ covenant on the land precludes the new zoning from going into effect. The developers indicated that they intended to modify their contract with the HOA’s to allow the city’s new zoning. City officials state that they do not intend to interfere with the private contract between the developer and the HOA’s, however the Happy Canyon HOA’s recent legal action was founded on the belief that there is an intent to help break their contract with the developer. (Note that there are thousands of pages of documentation on the history of the zoning for The Canyons. Please e-mail Editor to review the research and view the citations).

What is the timing on the URA process?

Another question that is being raised is that the intent to form the URA has only recently come to the attention of the public and the affected tax entities.

The City’s CPN Facts website states that, “From the beginning, city founders have always viewed creation of a URA as a vital tool for economic stability and long-term success of our city. …The city began discussing creation of a URA in 2007 when efforts to incorporate as a city were ongoing. Discussions of and plans for a URA have continued consistently since that time, and active discussion on this topic took place in the Castle Pines Economic Development Council during 2008 and 2009 in conjunction with a study by the Colorado Office of Economic Development and International Trade.”

The City’s Annexation Agreement with The Canyons, dated October 2009, has reference to that property being included in an URA, and the formal petition to form a URA was initiated the following month, in November of 2009.

The rest of the steps for forming the URA were completed after HB1107 was introduced on January 15, 2010. The petition signatures were completed and submitted on January 20. The Council held a study session on URA’s at its January 26 meeting. By March 16, HB1107 had passed both the House and the Senate. At its March 23 meeting, the council authorized the city to proceed with contracting for the URA consultant to conduct a blight study and conduct meetings with affected parties. That contract was approved at the April 13 meeting, and the city posted a notice of an informational meeting on URA’s for the next evening, April 14. The governor signed HB1107 on April 14, with an effective date of June 1.

The city held a Public Hearing on April 27. That evening, the consultant presented the study results and plan, along with maps showing the properties that were included in the Plan. Following the Public Hearing, the council voted 6-1 to approve forming the Urban Renewal Authority, with Mayor Jeffrey Huff casting the sole “no” vote.

The City then published notice of the approval of the URA, and posted information about the URA on the city’s website. The City invited property owners and citizens to another informational meeting about the URA on May 19, and also gave notice of an upcoming public hearing on May 25, on the Urban Renewal Plan. Following that Public Hearing, the council voted 5-1 to approve the Plan, with Mayor Huff again casting the “no” vote.

Many of those attending the public hearing commented that the process had been rushed to beat the June 1 deadline for the new state law, and therefore did not allow sufficient time for resolving issues that had been raised. Council members who voted for the Plan noted that they wished to provide economic development tools for Castle Pines North, and that there would be other opportunities for input during subsequent stages of the URA’s operation, when the URA Commission would consider specific project proposals.

We want to know your thoughts and hear your questions regarding the city’s URA and Plan. E-mail the Editor with questions and/or comments